In 2018, China’s pet market totaled more than 200 billion yuan, and in recent years, the annual growth rate of about 30% is growing!

The number of people who own pets is increasing and the amount of money people spend on their pets has skyrocketed.

The average annual spending by owners on their pets in 2018 was at $400, or $2,000 if they were in a Tier 1 city;

Although cat and dog food is becoming more and more available and expensive, these pet owners can afford it;

What stresses pet owners out is the cost of medical care for their pets, with checkups alone accounting for 60% of medical costs;

When pets get sick, pet owners who consider their pets to be family are generally willing to pay high medical bills, usually ranging from a few thousand dollars to tens of thousands of dollars, as long as they can afford to do so.

The rising cost of pet healthcare year on year has opened up a business opportunity for entrepreneurs who believe more and more people will choose to insure their pets.

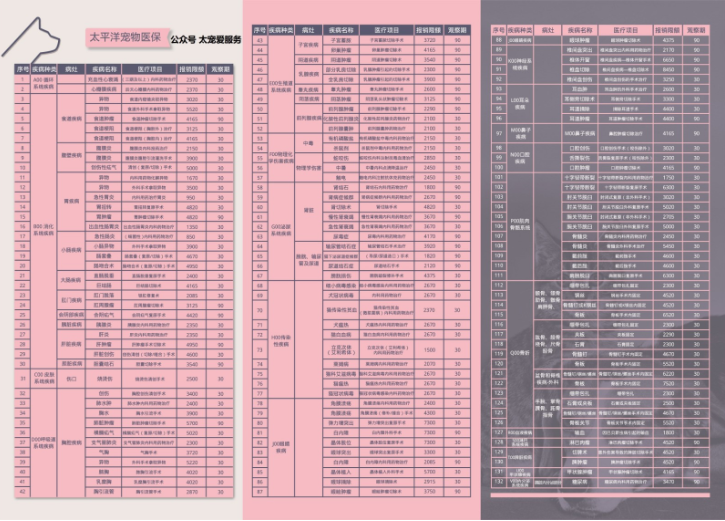

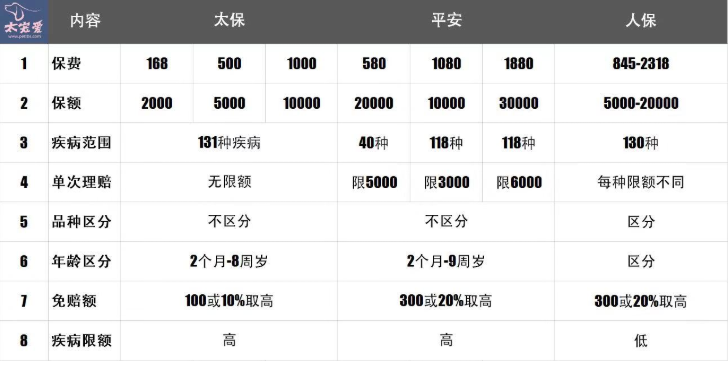

At present, the domestic Pacific Insurance, Ping An Insurance, People’s Insurance, the 3 main insurance companies, has launched a pet medical insurance, so that many pet owners benefited greatly, to solve the problem of expensive cats and dogs to see the doctor. At present, the claim situation is good, the country has millions of owners for the pet insurance; more than 2,000 hospitals across the country, to become the 3 major insurance companies designated hospitals for pet insurance.

Here’s a comparison of Pacific’s Too Pampered Pet Insurance, Ping An’s Moeng Security, and PICC’s Pampered Pet Insurance, the 3 main players in the lineup

Other countries have much higher rates of pet insurance, such as Sweden where 30% of pets are insured and the UK where 20% of pets are insured. British insurance startup Bought By Many was recently listed by Wired as one of the hottest startups in London; the online group insurance company, founded in 2012 and with more than 500,000 members, also launched a pet insurance business in 2017, which is now the company’s primary source of sales.

Pet insurance premiums in the UK are expected to rise from £976 million in 2015 to £1.6 billion by 2021, according to market research firm Mintel.

The situation in the United States is similar to Hong Kong in that pet insurance coverage is much smaller, with 1.83 million pets enrolled in 2017, representing only 1% of all pets.

But the growth rate is staggering; in 2017, pet insurance premiums in the U.S. rose 23 percent to $1.03 billion, and the number of pets enrolled rose 16 percent.

The U.S.-based entrepreneurs hold a similar idea to Hong Kong startup OneDegree, that one day pet insurance will be as recognized as it is in the U.K., which means huge room for market growth.

There are 80 types of pet insurance policies on sale in the U.S. market today, 15 percent more than four or five years ago.

Typically, owning a pet in the U.S. costs about $250 per year, and pet insurance costs $25 to $45 per month.

With the improvement of material living standards, the number of Chinese pet owners and the amount of money spent on pets are increasing, and the pet industry is continuing to develop at a rapid pace. 2018, China’s total pet market has exceeded 200 billion yuan, and in recent years, the annual growth rate of about 30 %. This has attracted the favor of capital, the most typical of which is Gao Tiling Capital, which invested in Ruipeng in the early days. Gao Tiles Capital is a very good at investing in Internet enterprises, equity investment institutions, it sold the Jingdong stared at the pet industry, bought hundreds of pet hospitals, the whole industry chain in the pet industry layout. In the pet industry chain, located in the upstream is pet breeding and trading, pet food and supplies production and sales, located in the downstream is pet medical, pet beauty, pet training, pet insurance and other parts. When the competition in the upstream of the pet industry chain becomes more and more intense, more and more entrepreneurs start to pay attention to the business opportunities in the downstream of the industry chain.

The pet insurance business is currently more profitable compared to the insurance business for human customers.

A 2014 Forbes story reported that PetPlan, a pet insurer, had only one-third of its policyholders file claims, that only 60 percent of the company’s revenues were used to pay for medical expenses, far less than the 80 to 85 percent of the average insurer, and that 80 percent of its policyholders renewed their policies.

Against this trend and backdrop, the pet insurance industry, which has a huge market gap, is becoming a business windfall for entrepreneurs to focus on.